News - Nov 15, 2024

Qxtender Sunset Announcement

Qxtender, our application that has interfaced with Intuit QuickBooks Desktop for the past 25 years, is now on a sunset path for payroll-related plugins that will conclude by the end of 2025, and limited support for other Plugins after that.

Why? Two main reasons, mostly related to changes in the QuickBooks desktop ecosystem and the inexorable shift to online everything.

- The Qxtender user base has long been declining, but the change by Intuit to a subscription model for desktop versions with QB 2022 accelerated that trend. Intuit earlier this year announced the end of sales of new desktop licenses to Pro and Premier versions, which went into effect this past October 1st. Only Enterprise will continue to be sold to new desktop users, for the time being.

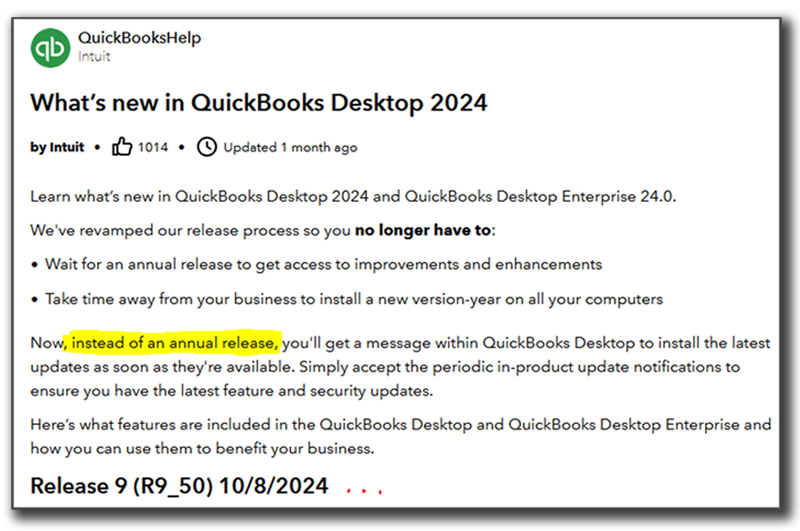

- Communication from Intuit to the desktop add-on developer community—regarding for-testing-only editions of QB software and further changes to the releases of versions and updates (where is QB 2025? Will there be a QB 2025? This cryptic notice* isn't much help.)—has become less than forthcoming and ultimately untenable.

What this means for Qxtender and its Plugins going forward during the sunset period:

- Qxtender will be updated soon to remove any Direct Mode License update requirements, with none of our usual fees if Intuit releases a 2025 or some other named new version. This is being done to ensure any changes made by Intuit to versioning will not break the validity of your existing license to use Qxtender during the sunset period. We are unable to test against new releases of QB going forward. We expect that the QB SDK interface will continue to behave normally, but if not, we cannot guarantee a fix and support will end at that point. Qxtender can be used unsupported indefinitely after the sunset period with Plugins that are not discontinued.

- Payroll related Plugins that require only minor/moderate updates for 2025 will be updated prior to the 1st quarter reporting period in April 2025 with the caveat that it is dependent on the QB SDK interface to remaining stable. Plugins requiring major updates will be discontinued at that time.

Specifics for each Plugin:

Discontinued soon:

- NY - NYS-45 Quarterly Report: Discontinued after 4th quarter 2024 filing period due by end of January 2025. The NYS tax agency recently released completely redesigned NYS-45 tax forms for use starting in the 1st quarter 2025, which would require and constitute a major update.

Discontinued after 2025 filing ends at end of January 2026, but possibly sooner:

- IRS - 941 & Schedule B: Update to be released for 2025 by April. Discontinued at end of 2025 filings or earlier if Intuit breaks the QB SDK interface.

- CA - DE-9/9C Quarterly Report: Update to be released for 2025 by April. Discontinued at end of 2025 filings or earlier if Intuit breaks the QB SDK interface.

- TX - C-3/C-4 Quarterly Report: Update to be released for 2025 by April. Discontinued at end of 2025 filings or earlier if Intuit breaks the QB SDK interface.

- CA - DE-542 Contractor Report: Discontinued at end of 2025 filings or earlier if Intuit breaks the QB SDK interface.

Open ended sunset. Will continue to work, until they don't:

- Contacts Exporter: No fixed discontinuance date. Will continue to function unsupported until QB SDK interface fails.

- Leads Exporter: No fixed discontinuance date. Will continue to function unsupported until QB Application Controller Mode interface fails.

- ShipTo Address Exporter: No fixed discontinuance date. Will continue to function unsupported until QB SDK interface fails.

Other Qtools applications:

Qslip will continue to be supported, since it is not so tightly coupled to QuickBooks. Other new applications in other arenas may follow.

Final Words...

We appreciate your business over the years and decades, and wish you the best.

If you have questions regarding any of this, please email us at the usual address.

[revised 18 Nov 2024, 20 Nov 2024.]

* Screen Cap from What's New link for QuickBooks Desktop Premier 2024:

|